Discover and read the best of Twitter Threads about #FederalReserve

Most recents (24)

La #FederalReserve sospende gli aumenti dei tassi di interesse, si rimane al 5,25% - 5,00%.

Cosa ci si può aspettare ora?

#FED #Bitcoin

Cosa ci si può aspettare ora?

#FED #Bitcoin

1/10 *Thread* 🧵

🚀 US Labor Market: May payrolls rise by 339K, surpassing the 190K Dow Jones estimate, and marking the 29th straight month of positive job growth. Unemployment rate increases slightly to 3.7% - still near the lowest since 1969. #LaborMarket #JobGrowth

🚀 US Labor Market: May payrolls rise by 339K, surpassing the 190K Dow Jones estimate, and marking the 29th straight month of positive job growth. Unemployment rate increases slightly to 3.7% - still near the lowest since 1969. #LaborMarket #JobGrowth

2/10

📈 This surge in job creation reveals a resilient labor market despite various challenges. Average hourly earnings, a key inflation indicator, rose 0.3% for the month, and wages increased 4.3% annually. #EconomicGrowth #Inflation

📈 This surge in job creation reveals a resilient labor market despite various challenges. Average hourly earnings, a key inflation indicator, rose 0.3% for the month, and wages increased 4.3% annually. #EconomicGrowth #Inflation

3/10

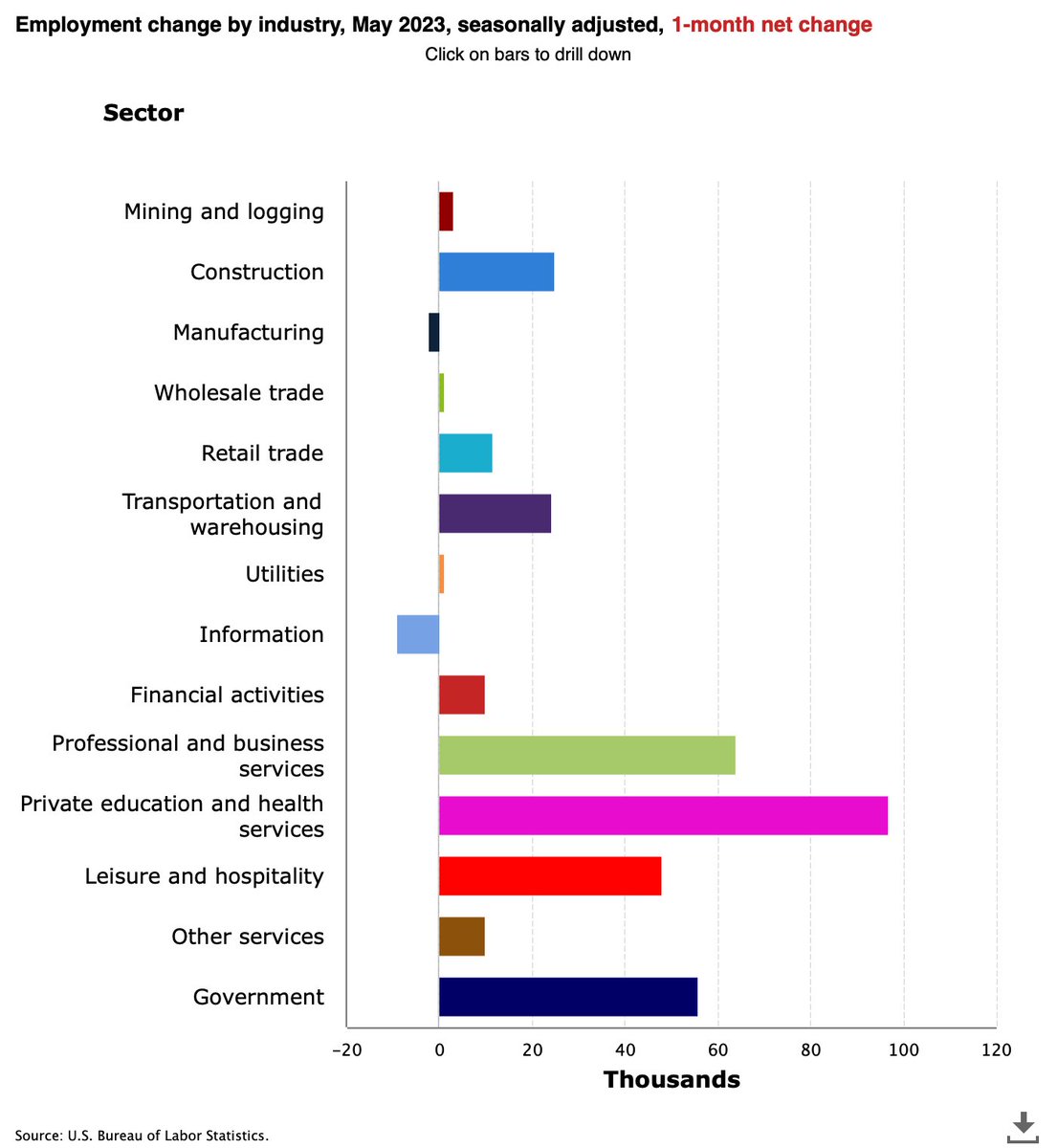

💼 Job creation is led by professional and business services (64K new hires), followed by government (56K) and healthcare (52K). Other notable sectors include leisure and hospitality (48K), construction (25K), and transportation and warehousing (24K). #JobCreation

💼 Job creation is led by professional and business services (64K new hires), followed by government (56K) and healthcare (52K). Other notable sectors include leisure and hospitality (48K), construction (25K), and transportation and warehousing (24K). #JobCreation

Is it legal for Congress to #default on the US #NationalDebt? It depends on who you ask. There are a ton of good legal arguments for and against, so perhaps it comes down to what the (degraded, corrupt, illegitimate, partisan) #SupremeCourt says?

nytimes.com/2023/05/04/opi…

1/

nytimes.com/2023/05/04/opi…

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/05/26/min…

2/

pluralistic.net/2023/05/26/min…

2/

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

The #BankingCrisis is severe and it’s all caused by the #FederalReserve and the worlds central banks.

The central banks printed about $10-$12 trillion since the pandemic hit to cover for the lost productivity as economies were shutdown. FED did not fix all the problems since 2007 crisis, instead it had sold worthless treasury bonds to most banks while interest rates were dirt cheap. Now that FED increased interest rates so high so fast to fight inflation, these bonds lost tremendous value and the fractional reserve banks were completely out of liquidity as soon as <10% of clients started withdrawing holdings from their accounts.

The #GreatFinancialCollapse during 2007-2008 saw 200+ banks collapse to about $510 billion. Compared to that we just have 3-5 banks fail with much higher valuations. #BankingCrisis is just the beginning. Next comes the credit crunch, the commercial real estate bubble collapse and as the recession worsens people lose jobs and the real estate bubble might collapse.

A thread 🧵 for your awareness👇

The central banks printed about $10-$12 trillion since the pandemic hit to cover for the lost productivity as economies were shutdown. FED did not fix all the problems since 2007 crisis, instead it had sold worthless treasury bonds to most banks while interest rates were dirt cheap. Now that FED increased interest rates so high so fast to fight inflation, these bonds lost tremendous value and the fractional reserve banks were completely out of liquidity as soon as <10% of clients started withdrawing holdings from their accounts.

The #GreatFinancialCollapse during 2007-2008 saw 200+ banks collapse to about $510 billion. Compared to that we just have 3-5 banks fail with much higher valuations. #BankingCrisis is just the beginning. Next comes the credit crunch, the commercial real estate bubble collapse and as the recession worsens people lose jobs and the real estate bubble might collapse.

A thread 🧵 for your awareness👇

Here’s a prev thread 🧵 on the FED

At the beginning of 2023 US banks had assets just 10% over liabilities. With the interest rates being so high, with the credit crunch, with dwindling banks liquidity, with bonds getting worthless by the day… it’s not hard to imagine these banks collapsing under mounting debt pressures.

Consolidation is the name of the game as these small banks collapse. They’re all being merged into the top 4 - JPMorgan Chase, Bank of America, CitiBank and Wells Fargo.

Consolidation is the name of the game as these small banks collapse. They’re all being merged into the top 4 - JPMorgan Chase, Bank of America, CitiBank and Wells Fargo.

The #FederalReserve is paying $275 billion a year to Wall Street to hide inflation it created with the help of the crony Wall Street banks.

A portion of the dollars FED creates and loans out to banks, is parked at the FED by those banks and FED pays out interest on that money.… twitter.com/i/web/status/1…

A portion of the dollars FED creates and loans out to banks, is parked at the FED by those banks and FED pays out interest on that money.… twitter.com/i/web/status/1…

Here’s a prev thread on the FED

Senator Ron Johnson: You’re gonna drive the debt from $32 trillion to $50 trillion… correct

Janet Yellen: Yes… but the metric that matters the most is relative debt to GDP ratio

Who’s gonna buy your debt?

Janet Yellen: Yes… but the metric that matters the most is relative debt to GDP ratio

Who’s gonna buy your debt?

A thread 🧵 on #CentralBanks for your awareness.

Gold has been considered hard money for 5000 years. 20% of all the gold ever mined is owned by central banks of the world. Why do central banks buy gold?

- Balancing foreign exchange reserves

- Hedging against fiat currencies

-… twitter.com/i/web/status/1…

Gold has been considered hard money for 5000 years. 20% of all the gold ever mined is owned by central banks of the world. Why do central banks buy gold?

- Balancing foreign exchange reserves

- Hedging against fiat currencies

-… twitter.com/i/web/status/1…

How much gold do we have in the entire world?

A cube (22m x 22m x 22m) is all the gold ever mined.

- 201,296 tons of gold (above ground, extracted)

- 53,000 tons of gold (below ground, unextracted)

46% used for jewelry

17% held by central banks

22% held by private investors… twitter.com/i/web/status/1…

A cube (22m x 22m x 22m) is all the gold ever mined.

- 201,296 tons of gold (above ground, extracted)

- 53,000 tons of gold (below ground, unextracted)

46% used for jewelry

17% held by central banks

22% held by private investors… twitter.com/i/web/status/1…

Here’s a prev 🧵 on #FederalReserve the largest central bank in the world

BTC Price Skyrockets 🚀– What's Next for Bitcoin?

Click "like" and RT for more content 🧵

1/ The Fed signaled that it tightened too hard and may need to pause or cut rates, which has to #bitcoin hitting $27K over night.

But where next for bitcoin? Lets dive in...

Click "like" and RT for more content 🧵

1/ The Fed signaled that it tightened too hard and may need to pause or cut rates, which has to #bitcoin hitting $27K over night.

But where next for bitcoin? Lets dive in...

2/ 📊 Recent data from Cointelegraph and TradingView revealed BTC/USD hitting $27,025 before consolidating. At the time of writing, the pair is around $26,500 , but WHY the sudden surge....? #BitcoinPriceMovement

3/ 🚀 A catalyst for this fresh upside came from the Federal Reserve's balance sheet data, showing almost $300 billion being injected into the economy as part of the banking crisis response. This further fueled the price movement for Bitcoin. #FederalReserve #BTC

#FederalReserve is the largest central bank in the world.

Citizen vs. State: If you look at the original founding principle objectives of the federal reserve, you can’t find a single one which benefits the citizen. The fifth objective is clearly a great lie we’ve all been… twitter.com/i/web/status/1…

Citizen vs. State: If you look at the original founding principle objectives of the federal reserve, you can’t find a single one which benefits the citizen. The fifth objective is clearly a great lie we’ve all been… twitter.com/i/web/status/1…

Here’s a prev 🧵 on #FederalReserve

Todays UNN show situation report by KimPossible was all about the #bankingcrash who caused it and why, needless to say it was yet another failed attempt by the remaining #blacksun minions > Watch 13-MAR-23 NEWS 1 unitednetwork.tv/videos/13-mar-…

Here is the last of #kimpossibles report from todays show. 13-MAR-23 NEWS 1 unitednetwork.tv/videos/13-mar-…

#quote: Jacob Rothschild passed away last weekend 80+ yrs old. Nathan Rothschild is running the family biz now. h/t KimPossible 13-MAR-23 NEWS 1 unitednetwork.tv/videos/13-mar-…

#Biden backs strength of #banking system after collapse of #SVB, #SignatureBank | Mar 13

- When fed auths bailed out depositors in insolvent lenders SVB (NASDAQ:SIVB) and #SignatureBank on Monday,

Joe sought to reassure the public

richtv.io/?p=245301

- When fed auths bailed out depositors in insolvent lenders SVB (NASDAQ:SIVB) and #SignatureBank on Monday,

Joe sought to reassure the public

richtv.io/?p=245301

#Ukraine-#BanderasBox opened.

#RAND Co | Jan 25

- There is an urgent need for #resources to flow into the national econ, especially the #banking system. Only European countries bound by #EU and #NATO commitments will be able to provide them

#RAND Co | Jan 25

- There is an urgent need for #resources to flow into the national econ, especially the #banking system. Only European countries bound by #EU and #NATO commitments will be able to provide them

#SVB #SignatureBank #BanderasBox.

#Rand Co | Jan 25

- The key objective is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent

- The entire #EU #economy will #collapse

#Rand Co | Jan 25

- The key objective is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent

- The entire #EU #economy will #collapse

The Federal Reserve have announced a new system created to protect banks from collapse in response to SVB and Signature Bank.

They've called it the Bank Term Funding Programme

Let's get this explained simply 👇

They've called it the Bank Term Funding Programme

Let's get this explained simply 👇

A large part of the reason SVB collapsed was because it bought a massive amount of low interest US T-Bills that plummeted in value after interest rate hikes and inflation rendered their return absolutely terrible.

When SVB was forced to raise liquidity they had to sell these bonds at massive losses, accruing heavy losses from those that they sold

Here is this Week’s Market Wrap

'Banking on a Collapse' written by @shyamsek

A Thread (1/n)

#Banking #SiliconValleyBank #SVBCollapse #marketwrap

'Banking on a Collapse' written by @shyamsek

A Thread (1/n)

#Banking #SiliconValleyBank #SVBCollapse #marketwrap

One week is a long time in global banking. Or, so it seems if one goes by the latest inflation and interest rate commentary of the federal reserve Chairman Jerome Powell. (2/n)

#banking #inflation #interestrates

#banking #inflation #interestrates

The Silicon Valley bank collapse has almost caused a setting for a rapid reset of the interest rate trajectory in the US. (3/n)

#SiliconValleyBank #SVBCollapse #interestrates

#SiliconValleyBank #SVBCollapse #interestrates

#FederalReserve is the largest central bank in the world. It’s the US central bank with a GDP of roughly $25 trillion and debt of up to $32 trillion. US is already 130% debt-to-GDP ratio. It’s not sustainable at the current high FED interest rates reaching 5%+

The interest… twitter.com/i/web/status/1…

The interest… twitter.com/i/web/status/1…

#DebtLimits are just a fake virtue signaling asking congress to approve increasing limits each year. We know that high debts aren’t sustainable.

See #FederalReserve chairman Jerome Powell asking congress for increasing debt limits to pay off its debts.

See #FederalReserve chairman Jerome Powell asking congress for increasing debt limits to pay off its debts.

Here’s a prev 🧵 on the FED

During the past week, I and we conducted an in-depth analysis of the U.S. #economy . The results were not encouraging.

First, I discovered that the banking sector was more fragile than previously thought.

🧵1/8

mtmalinen.substack.com/p/the-us-econo…

First, I discovered that the banking sector was more fragile than previously thought.

🧵1/8

mtmalinen.substack.com/p/the-us-econo…

It also seemed that the U.S. credit markets were in the grips of a (fallacious) complacency, shown on the proportionally milder reaction of the "junk" bonds on the current tightening cycle.

But, can the #Fed support the markets in the current situation? We're not so sure.

2/

But, can the #Fed support the markets in the current situation? We're not so sure.

2/

The global business cycle is forecastable around 4-5mo ahead and the provision of liquidity into the financial markets is forecastable around 2-3mo ahead, currently.

The onset of economic crises is much more cumbersome and uncertain to forecasts.

A short 🧵on what's coming. 1/6

The onset of economic crises is much more cumbersome and uncertain to forecasts.

A short 🧵on what's coming. 1/6

The flow of aggregate financing in China sputtered in October and fell of a 'cliff' in Nov/Dec. This implied that

1) This month will see first signs of a renewed decline in econ. indicators.

2) Decline will deepen in March and April.

Details. 👇

2/

1) This month will see first signs of a renewed decline in econ. indicators.

2) Decline will deepen in March and April.

Details. 👇

2/

Global liquidity has been driven by China especially during this year with the onset of QT:s by the #FederalReserve and the #ECB.

The slump in October was followed by a massive increase in November, which lifted the markets. 3/

The slump in October was followed by a massive increase in November, which lifted the markets. 3/

Here's a thread of (6) charts 📊 that are worth nothing from this last week's @MorganStanley Global Investment Committee (GIC) Weekly Report (01/30/23)... 🧵/👇🏼

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

1/🧵 "In the short run, flows, sentiment, positioning & technicals can be powerful drivers, while over the longer term, fundamentals like growth, profitability & productivity are critical, as are earnings surprises." @MorganStanley

#macro #earnings #stocks #StockMarket #bonds

#macro #earnings #stocks #StockMarket #bonds

2/🧵 "But sometimes, & for extended periods, markets can settle on one particular thesis, no matter how narrow or implausible." 📊h/t @MorganStanley @GoldmanSachs $MS $GS @Bloomberg

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

US President Woodrow Wilson sold America like a stock to those elite bankers financiers like JP Morgan, Rockefellers, Rothschild, Warburg and Jacob Schiff who ended up creating the #FederalReserve

This single act undermined all the US taxpayers ever since. A thread 🧵

This single act undermined all the US taxpayers ever since. A thread 🧵

Here’s a prev 🧵 on #FederalReserve

A thread prior on #FederalReserve

Wondering about latest news 📰 in the #realestate #housingmarket 🏡💵 with pricing, #interestrates, etc.? Here's an updated thread for January 23' that includes all the latest macro/market data... 🧵/👇🏼

📊h/t @RealEstateCafe

📊h/t @RealEstateCafe

1/🧵 "44% year/year drop in @MBAMortgage

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

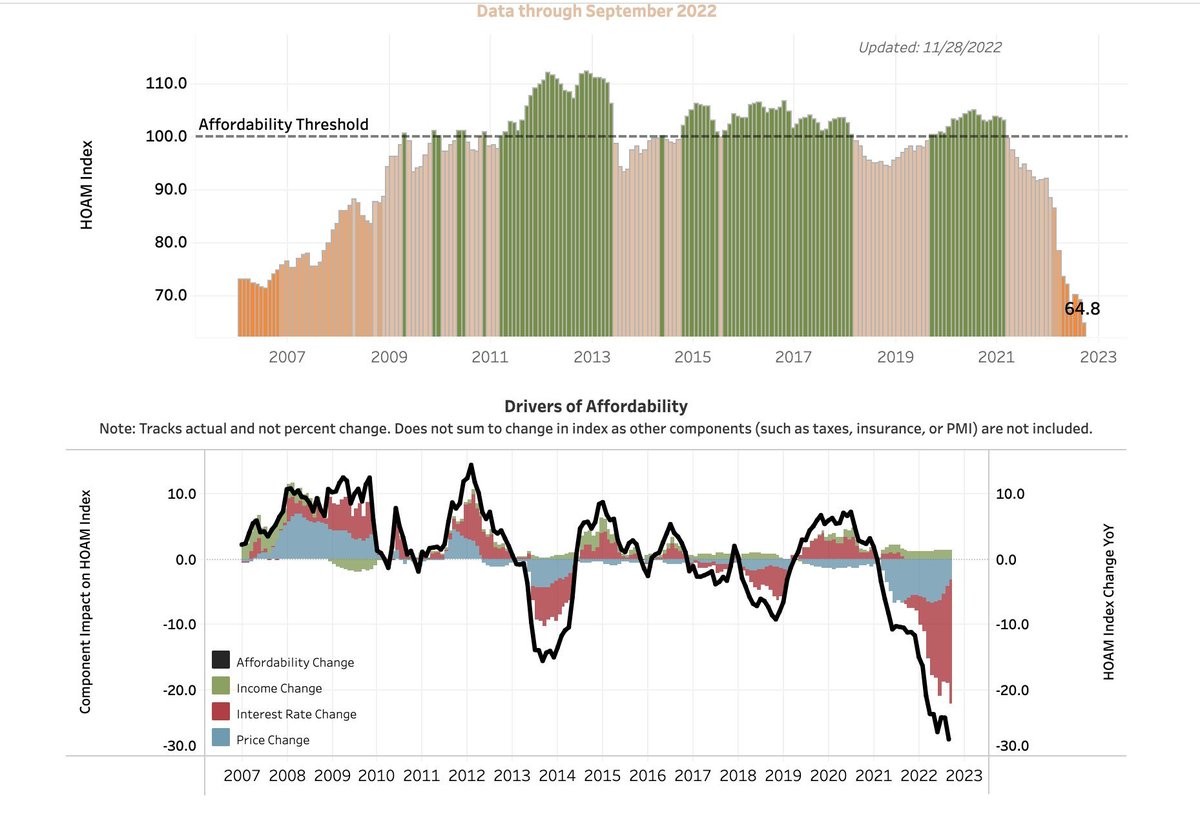

2/🧵 Affordability "threshold" for housing, via the @AtlantaFed 🏡

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

🔥#Bitcoin in fiamme negli ultimi giorni🔥 Inversione di tendenza o bear market rally?

Approfittiamo oggi del momento di stasi del mercato per capire in che fase ci troviamo e come mi sono mosso in questi giorni ⬇️🧶

Approfittiamo oggi del momento di stasi del mercato per capire in che fase ci troviamo e come mi sono mosso in questi giorni ⬇️🧶

A confluence of unprecedented events in 2022 weakened asset prices across all markets. (1/n)

#assetallocation #investing #personalfinance #throwback #thread

#assetallocation #investing #personalfinance #throwback #thread

The Fed’s pivot to a less aggressive monetary policy is likely to set the tone for the markets in 2023. (2/n)

#FED #FederalReserve #monetarypolicy

#FED #FederalReserve #monetarypolicy

It is expected that global inflation will continue to be higher in this decade, in combination with a significant slowdown of the U.S. economy. (3/n)

#inflation #interestrates #globalmarket

#inflation #interestrates #globalmarket

An argument for why the Gambler's Fallacy, the Recency Bias, and Conditional Heteroskedasticity could set up an attractive asymmetric return profile ahead of Wednesday's US inflation (#CPI) data ...

🧵 1/n

🧵 1/n

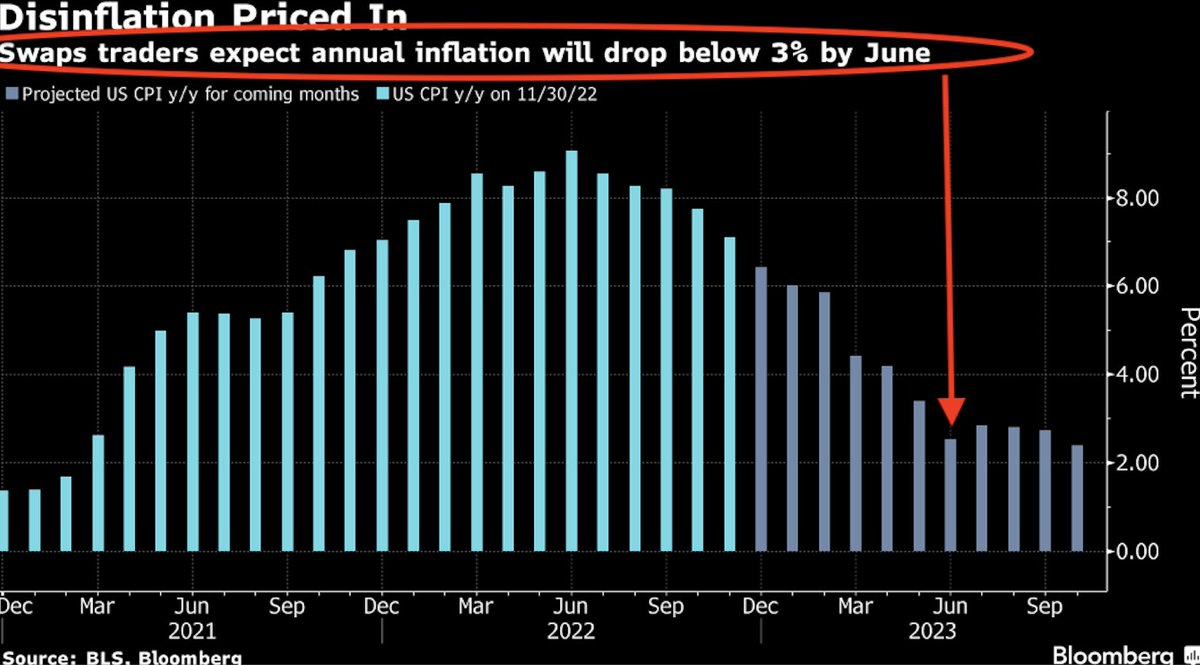

Headline CPI is forecasted to come in at 6.5% YoY, compared to 7.1% the month before. CPI has clearly been trending downward since June 2022, which is positive for the #economy and risky assets as it puts a ceiling on how high the #FederalReserve has to raise rates.

2/n

2/n

The Gambler's Fallacy & Recency Bias:

CPI swaps indicate that CPI should be approx. 2.5% (!) this June. This seems to be an example of the "Gambler's Fallacy"; a misunderstanding of #probabilities in which people wrongly project reversal towards a long-term mean.

3/n

CPI swaps indicate that CPI should be approx. 2.5% (!) this June. This seems to be an example of the "Gambler's Fallacy"; a misunderstanding of #probabilities in which people wrongly project reversal towards a long-term mean.

3/n

As we kickoff 23', here's a thread w/ the latest data 🏦💵🖨 on #StockMarket liquidity, credit, & financial conditions within the broader markets... 🧵/👇🏼

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

1/🧵 One of the indicators we watch is the @federalreserve 'Net Liquidity' as this tracks the markets very closely....

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

2/🧵 In addition to this, investors also have to look past the @federalreserve as global Central Banks 🏦 have joined in QT against the #inflation backdrop...

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

My latest post, on the #FederalReserve, #banking, and #money is here.

The Dark Origins of The Federal Reserve (Part 1): Economic Alchemy

redpillhistory.substack.com/p/the-dark-ori…

The Dark Origins of The Federal Reserve (Part 1): Economic Alchemy

redpillhistory.substack.com/p/the-dark-ori…

Part 2 of my #FederalReserve exposé is now live.

Find out the truth about the secret meeting on #JekyllIsland -- and how six men radically changed U.S. history.

redpillhistory.substack.com/p/the-dark-ori…

Find out the truth about the secret meeting on #JekyllIsland -- and how six men radically changed U.S. history.

redpillhistory.substack.com/p/the-dark-ori…

The last segment of my #FederalReserve deep-dive is now out.

This post explains why the Fed enslaves you and causes war.

redpillhistory.substack.com/p/the-dark-ori…

This post explains why the Fed enslaves you and causes war.

redpillhistory.substack.com/p/the-dark-ori…