Geopolitical analyst & Engineer, working on the chessboard between Emerging Tech, Economy & State Power. Founder Policy 4.0. | Worked with Capitol Hill, EY, G20

13 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/tanvi_ratna/status/1907880105369845865

Historically, tariff shocks redirected global capital into Treasuries—lowering yields, strengthening the dollar, and easing U.S. refinancing.

Historically, tariff shocks redirected global capital into Treasuries—lowering yields, strengthening the dollar, and easing U.S. refinancing.

First, let's recap the tariffs:

First, let's recap the tariffs:

Start with the debt: $9.2T must be refinanced in 2025.

Start with the debt: $9.2T must be refinanced in 2025.

https://twitter.com/tanvi_ratna/status/1889180588738781674Here's a thread of how AI policy across jurisdictions was overwhelmingly focused on safety so far

1/ The National Emergencies Act (NEA)

1/ The National Emergencies Act (NEA)

https://twitter.com/rishabhmansur2/status/1488411292113063941The #India #crypto #bill was expected to be tabled in final form in this budget session. It might be so if the cabinet clears it but the bill is expected to be finalized by May. The motivations behind today's announcement is not clarity per se but signaling:

India's adoption of #cryptocurrency is ramping up exponentially, signalling a clear demand for these tokens in the country. India recently ranked a whopping second on Chainalysis's Global #Crypto Adoption Index @chainalysis @SEBI_India @nsitharaman @RBI @NPCI_NPCI

India's adoption of #cryptocurrency is ramping up exponentially, signalling a clear demand for these tokens in the country. India recently ranked a whopping second on Chainalysis's Global #Crypto Adoption Index @chainalysis @SEBI_India @nsitharaman @RBI @NPCI_NPCI

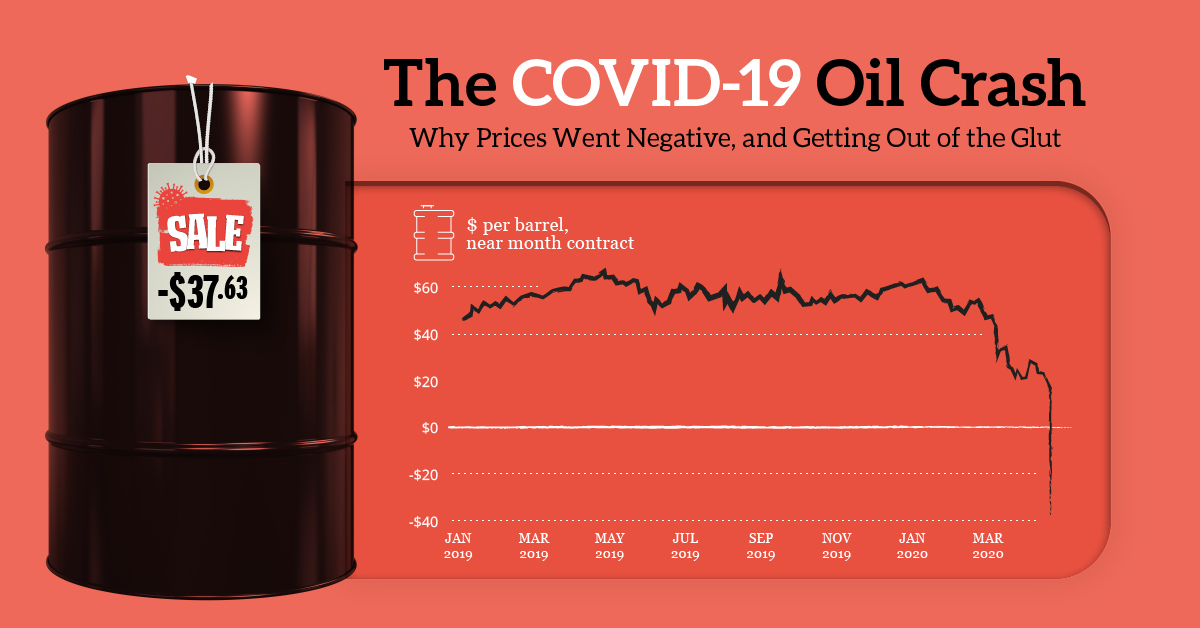

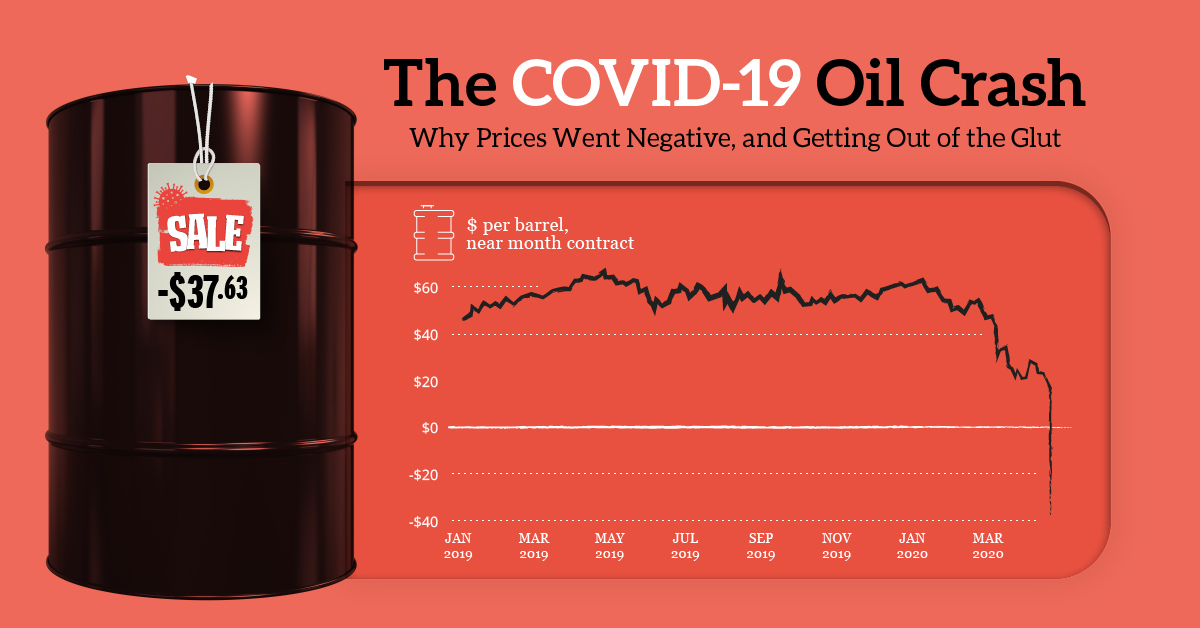

US #oilprice crashed negative for the 1st time in history. West Texas Intermediate (a US crude) traded as low as -$40.32 a barrel. So far the bulk of the losses are in US crude, -200 to -1000%! Global (Brent) crude has not gone down as much because global storage still exists.

US #oilprice crashed negative for the 1st time in history. West Texas Intermediate (a US crude) traded as low as -$40.32 a barrel. So far the bulk of the losses are in US crude, -200 to -1000%! Global (Brent) crude has not gone down as much because global storage still exists.

https://twitter.com/moneycontrolcom/status/12527976931786260602. The recently launched NUE framework by the #RBI is possibly a big end game being targeted by the partnership. This framework allows for parallel payment infrastructure to UPI being set up countrywide. $5.7 bn is cheap for this scale of access & profit