Discover and read the best of Twitter Threads about #IMO2020

Most recents (11)

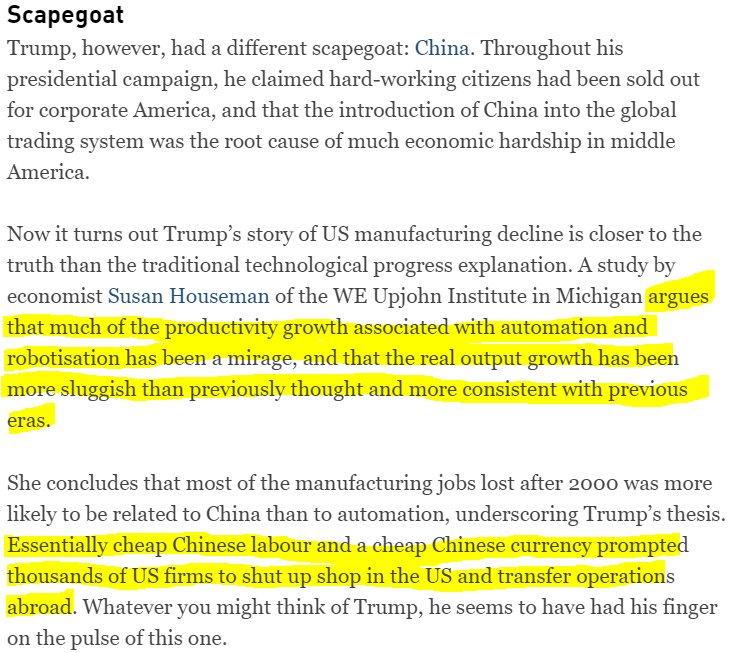

For decades this area has been kept relatively cool by sulfur emissions from ships.

But this changed in 2020.

But this changed in 2020.

I don't have blind faith oil will stay strong, and I acknowlede the oil market is rightly considered as somewhat opaque. There are two factors giving me confidence:

1) Crack spreads (record highs)

2) VLCC rates (near record lows)

#OOTT #COM #EFT $XLE $XOP $OIH $CL_F

1) Crack spreads (record highs)

2) VLCC rates (near record lows)

#OOTT #COM #EFT $XLE $XOP $OIH $CL_F

So first on crack spreads. This is your sanity check on "is demand destruction occurring". The crack spread is the difference between the price of crude and the price of products like gasoline and diesel. At incredible, historic, world beating levels.

What does this imply?

What does this imply?

Basically, that refineries have zero incentive to slow down. They cannot meet consumer demand. So fuel margins are at record highs. As long as this persists, refiners, the main buyer of crude, have a historic incentive to not only buy, but to bring more capacity online. Anything.

I'd like to share some thoughts about #tankers $EURN $STNG $FRO $DHT $TNK $INSW $ASC $TRMD $OET & the market in general.

It's counter-productive at best & delusional at worst to guide your investment decisions (I'm not talking about short-term trading) based on the market 1/n

It's counter-productive at best & delusional at worst to guide your investment decisions (I'm not talking about short-term trading) based on the market 1/n

whose inefficiency you seek to exploit.

Either you see a market inefficiency and move to exploit it or the market is pricing the asset efficiently and thus you move on (or accept market results).

From a short-term trading perspective things are different. You seek to 2/n

Either you see a market inefficiency and move to exploit it or the market is pricing the asset efficiently and thus you move on (or accept market results).

From a short-term trading perspective things are different. You seek to 2/n

ride the market's ups & downs & thus you must constantly be tuned to the market's fluctuations & try to see what comes next.

If you're investing, volatility isn't risk. Your risks lie on business performance.

You buy what you think the market will like in a year or more 3/n

If you're investing, volatility isn't risk. Your risks lie on business performance.

You buy what you think the market will like in a year or more 3/n

1/3 Hey @IMOHQ we've been thinking more about your response. Truth is, you're saying a lot of words, but all we're seeing is:

@IMOHQ The oceans are under threat from these systems now. Let us know when you’ve banned scrubbers. #CloseTheScrubberLoophole

@IMOHQ 3/3 To be clear, we're talking about MARPOL Annex VI, Regulation 4.1 - Scrubbers just don’t meet the standard. #CloseTheScrubberLoophole #IMO2020

📣On Jan 1st, a huge new international law came into effect, essentially ending the use of high-sulfur heavy fuel oil in shipping. *But ships are still bypassing the law with ‘emissions cheat systems’ - aka ‘scrubbers’.*

2. This new law from @IMOHQ should have an enormous impact on the shipping industry, as most ships still burn one of the dirtiest fuels on earth. But ships can cheat the system by installing ‘scrubbers,’ and keep using heavy fuel oil through a big loophole in the law.

@IMOHQ 3. How do scrubbers work? Most ships are installing the type that uses seawater to ‘wash’ sulfur from the ship exhaust. This contaminated wastewater is then just discharged into the ocean, turning air pollution into water pollution instead.

Thread

Colombia's oil is significant to US

1- The oil industry in Colombia has perfected replacing & fixing oil pipelines more than any other country in the world. It experienced more attacks on pipelines than any other country

democracynow.org/2019/11/22/col…

Colombia's oil is significant to US

1- The oil industry in Colombia has perfected replacing & fixing oil pipelines more than any other country in the world. It experienced more attacks on pipelines than any other country

democracynow.org/2019/11/22/col…

2- Although Colombia has experience with insurgency and attacks on pipelines for decades, large demonstrations are something different. However, oil fields are relatively away from population centers

Map is relatively old.

Map is relatively old.

3- Just like in Iraq and Iran, oil workers are from the local population, and might go on strike, crippling production and exports. A large number of Venezuelan petroleum engineers, geologists & others work in Colombia. They will get stuck in this political divide in Colombia

Thread on the impact of attacks on #Abqaiq #oil complex in the E. province in Saudi Arabia:

1- It is difficult at this stage to assess the impact of the attacks. While no details, we have to be mindful of the gagging orders & Saudi laws governing reporting, videos, and pictures.

1- It is difficult at this stage to assess the impact of the attacks. While no details, we have to be mindful of the gagging orders & Saudi laws governing reporting, videos, and pictures.

2-Will the attacks lead to lower crude oil exports? We do not know at this stage. Will they lower production? We do not know either. What do we know? Majority of Saudi oil exports goes through Abqaiq facilities.

3-What do we know? Redundancy is common in Saudi oil facilities, especially #Abqaiq. While costly, redundancy helps in case of technical problems or attacks similar to what we have seen today. The existence of backup means the impact on production and exports is limited.

1/Here is why you [the market] and the @IEA have got it wrong on #IMO2020.

This is what a 'little disruption' may entail....

#OOTT

This is what a 'little disruption' may entail....

#OOTT

FRIDAY MORNING IN ENERGY: And I’d like to talk energy, but really, I’ve got to talk trade first after we’ve got new tariffs coming, a lot of research notes, and very nervous markets… #OOTT #tradewar #China #trade

… as always you can follow our coverage here on Reuters.com. Our lead story right now is, the US escalated the trade war with more tariffs after the Chinese made major changes in the agreement that blew everything up earlier in the week.

reuters.com/article/us-usa…

reuters.com/article/us-usa…

Trump has said he’s in no rush to complete the deal. So we’ve got that going for us. #trade #china Ttradewar

reuters.com/article/us-usa…

reuters.com/article/us-usa…

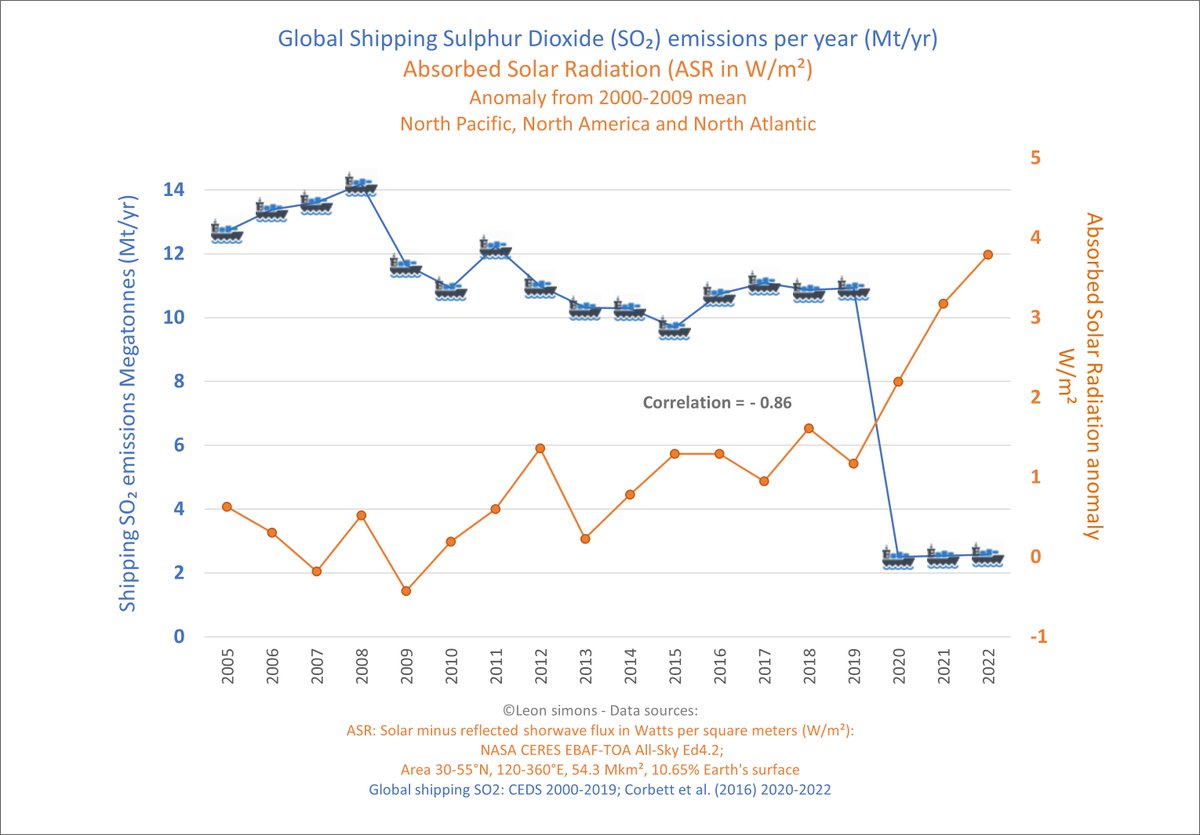

#demographics #militaries #economies #currencies

#USA

- Best demographics

- Largest military

- Largest economy

- Most used currency

- Liquid financial markets

- Open capital account

- Rule of law

- Best geography

- Can be self sufficient if required

- Not trade dependent

#USA

- Best demographics

- Largest military

- Largest economy

- Most used currency

- Liquid financial markets

- Open capital account

- Rule of law

- Best geography

- Can be self sufficient if required

- Not trade dependent

#USA

Top trade partners as of 30 June 2018:

- China: 15.2% (strategic competitor)

- Canada: 15.1%

- Mexico: 14.6%

- Japan: 5.1%

- Germany: 4.4%

The next 10 years could result in the below:

- Mexico (25%)

- Canada (20%

- Japan (7%)

- South Korea (5%)

- Great Britain (4%)

Top trade partners as of 30 June 2018:

- China: 15.2% (strategic competitor)

- Canada: 15.1%

- Mexico: 14.6%

- Japan: 5.1%

- Germany: 4.4%

The next 10 years could result in the below:

- Mexico (25%)

- Canada (20%

- Japan (7%)

- South Korea (5%)

- Great Britain (4%)

#USA

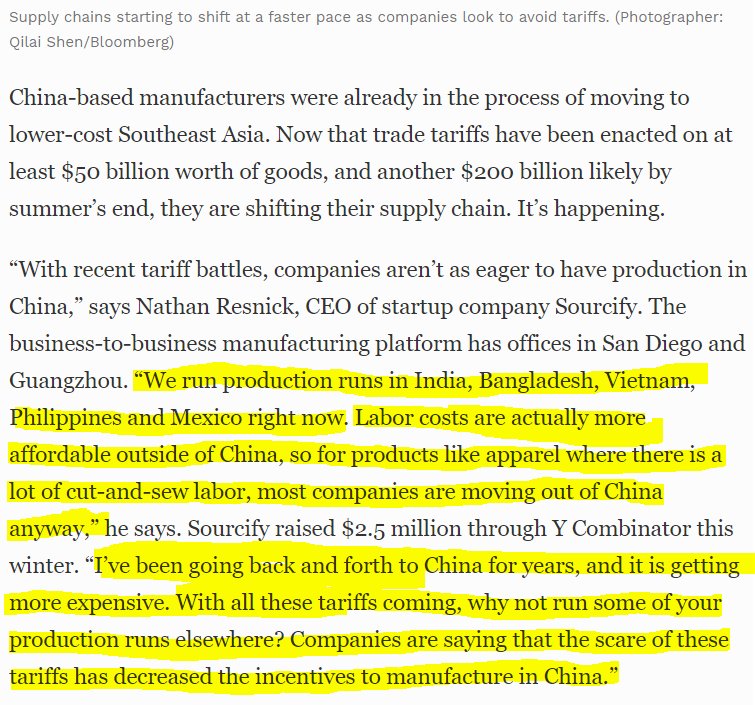

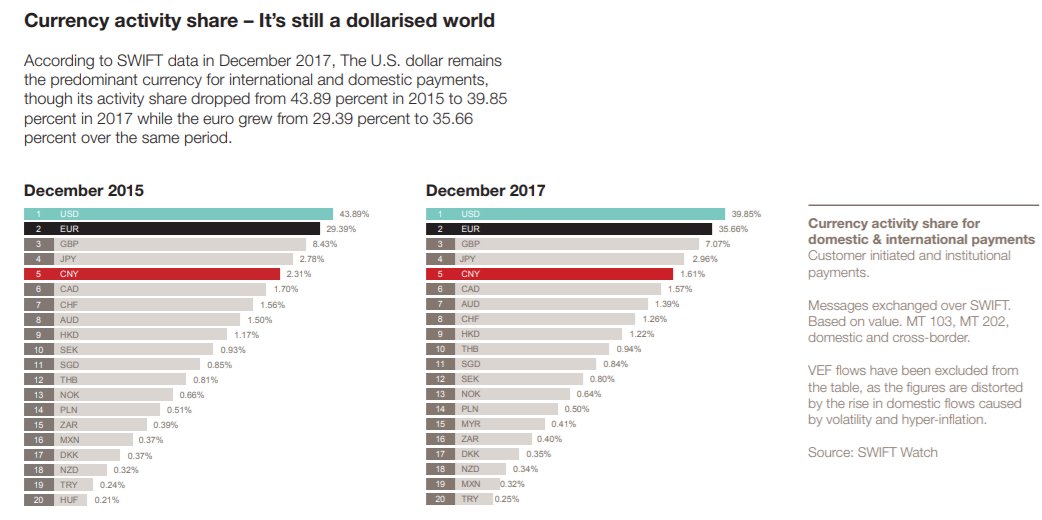

Bring the manufacturing (jobs) home while negatively impacting China's economy.

forbes.com/sites/kenrapoz…

cebglobal.com/talentdaily/au…

irishtimes.com/business/econo…

Bring the manufacturing (jobs) home while negatively impacting China's economy.

forbes.com/sites/kenrapoz…

cebglobal.com/talentdaily/au…

irishtimes.com/business/econo…