Your go-to place to understand what's happening in the Indian stock market and why. No drama, no nonsense — just insights.

How to get URL link on X (Twitter) App

Most of you watching or listening probably know that gold is often seen as a “safe haven” investment.

Most of you watching or listening probably know that gold is often seen as a “safe haven” investment.

Interestingly, just three airlines—IndiGo, Air India, and Vistara—control almost 90% of all domestic flights.

Interestingly, just three airlines—IndiGo, Air India, and Vistara—control almost 90% of all domestic flights.

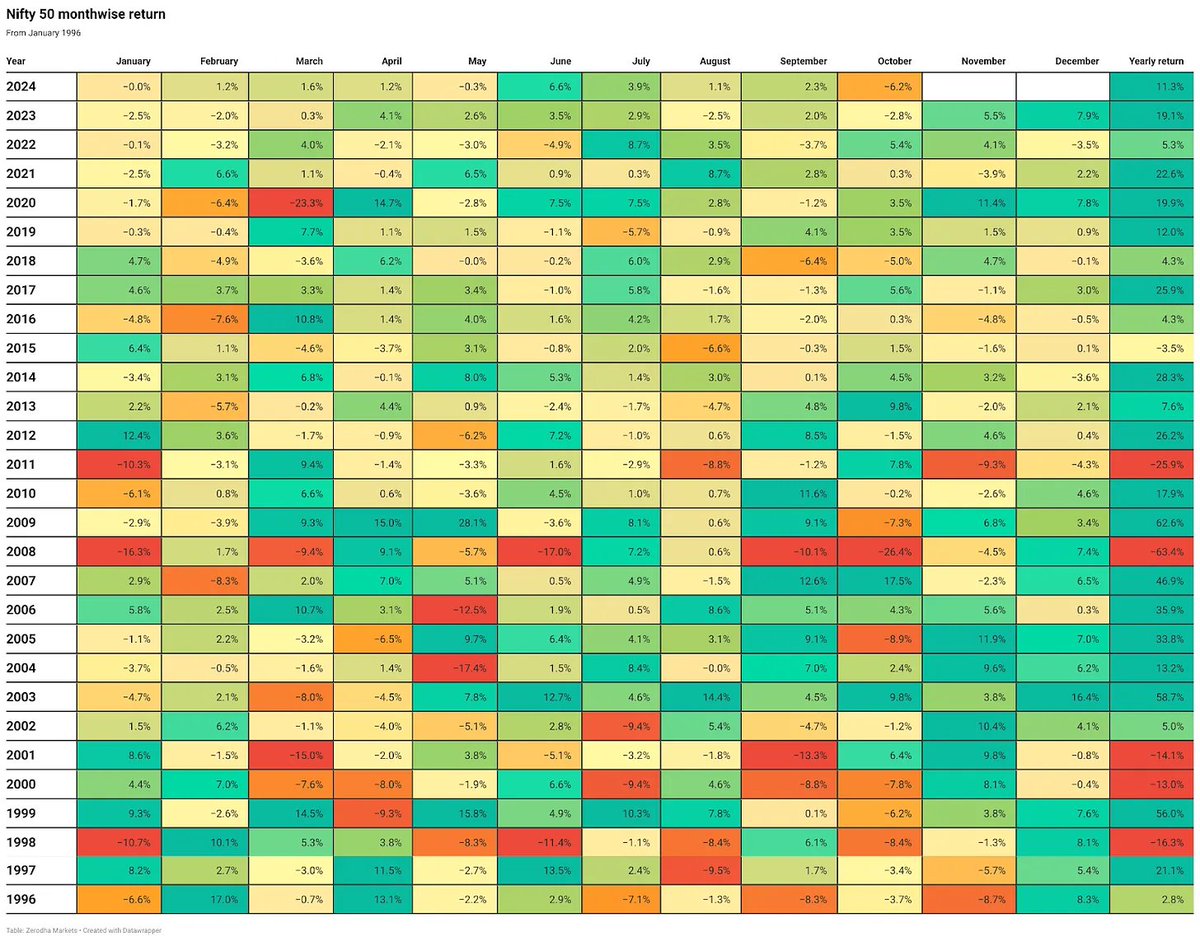

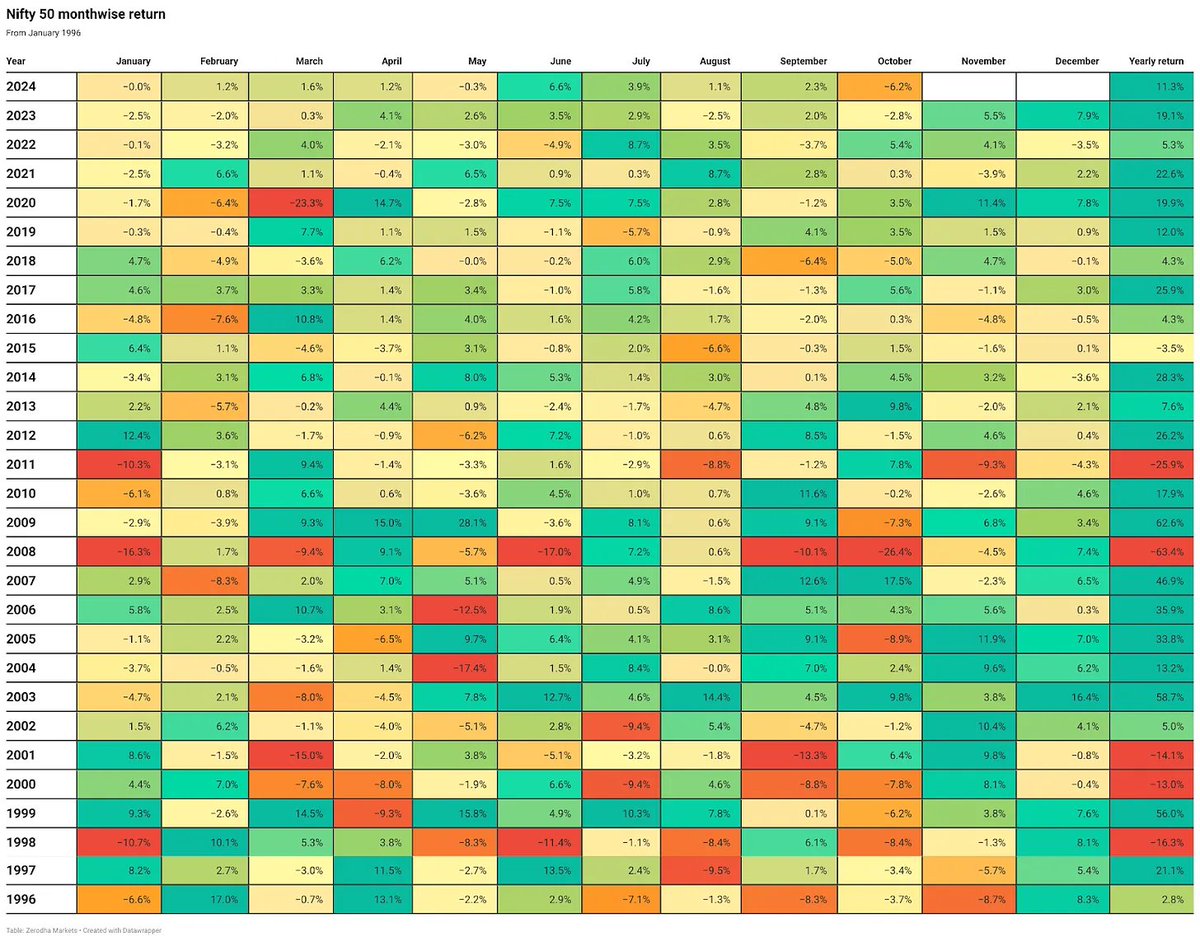

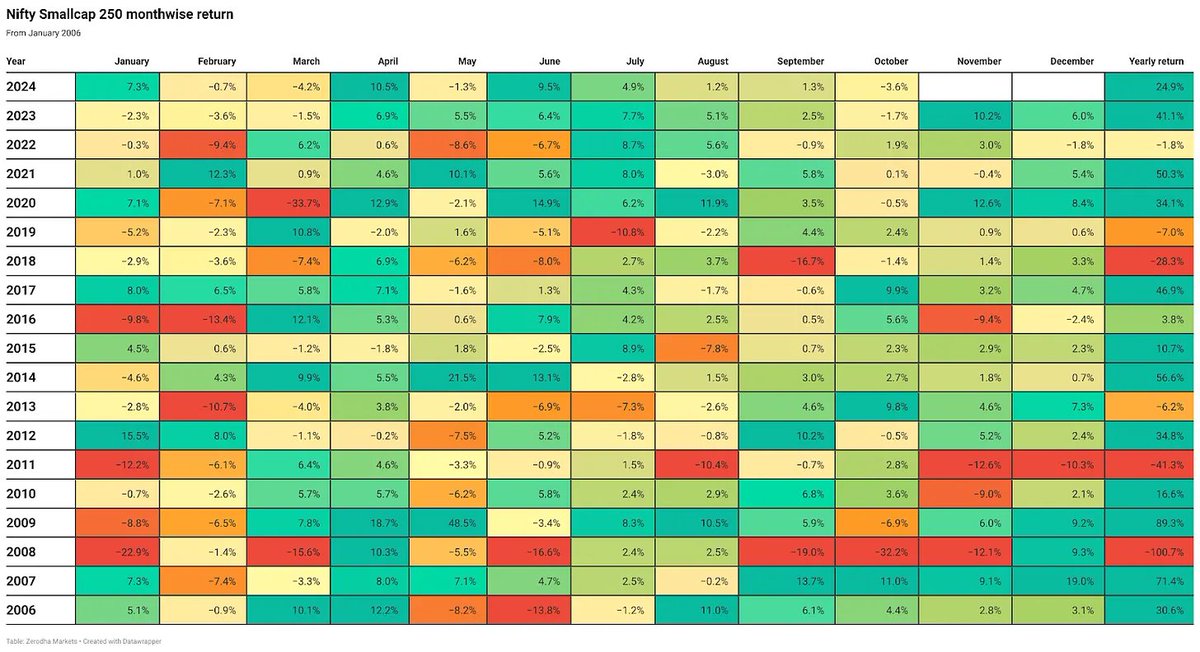

The Mid and Smallcap indices saw a similar trend, although Smallcaps were down by only around 3.6%. Despite October’s dip, the markets have still shown strong overall growth.

The Mid and Smallcap indices saw a similar trend, although Smallcaps were down by only around 3.6%. Despite October’s dip, the markets have still shown strong overall growth.

Nifty tested the 24,480-24,500 range for the third straight day before closing at 24,350.30. While headline indices dipped, the advance-decline ratio was a strong 3.05, indicating robust buying outside of the Pharma, Banking, and IT sectors.

Nifty tested the 24,480-24,500 range for the third straight day before closing at 24,350.30. While headline indices dipped, the advance-decline ratio was a strong 3.05, indicating robust buying outside of the Pharma, Banking, and IT sectors.

This creates a huge market for companies like United Spirits Limited (USL), part of the global beverage giant Diageo, and Radico Khaitan, one of India’s top homegrown brands.

This creates a huge market for companies like United Spirits Limited (USL), part of the global beverage giant Diageo, and Radico Khaitan, one of India’s top homegrown brands.