How to get URL link on X (Twitter) App

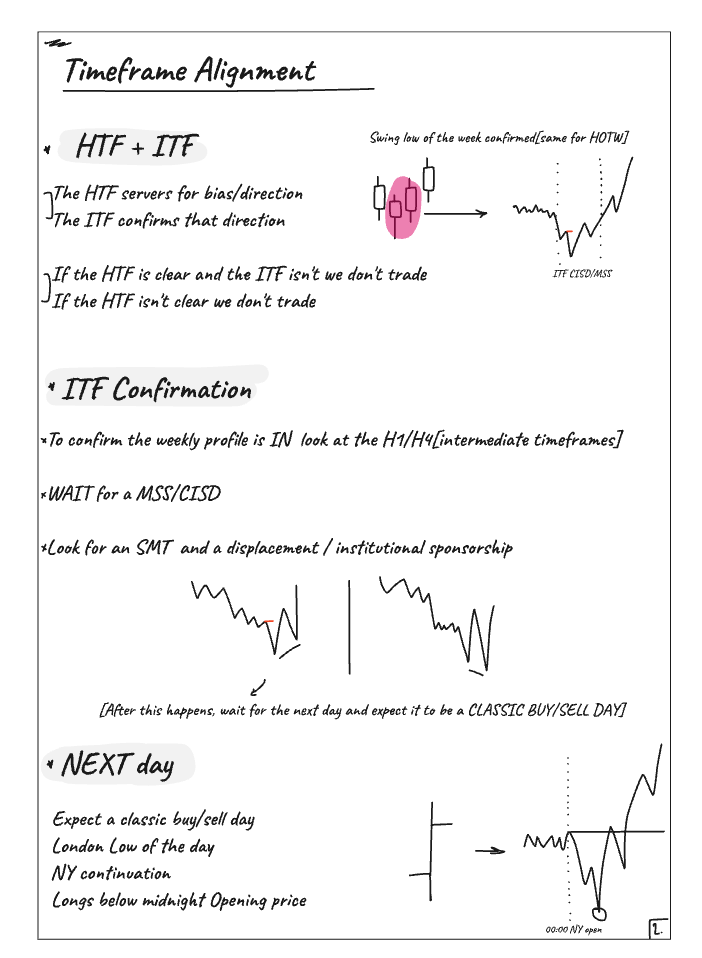

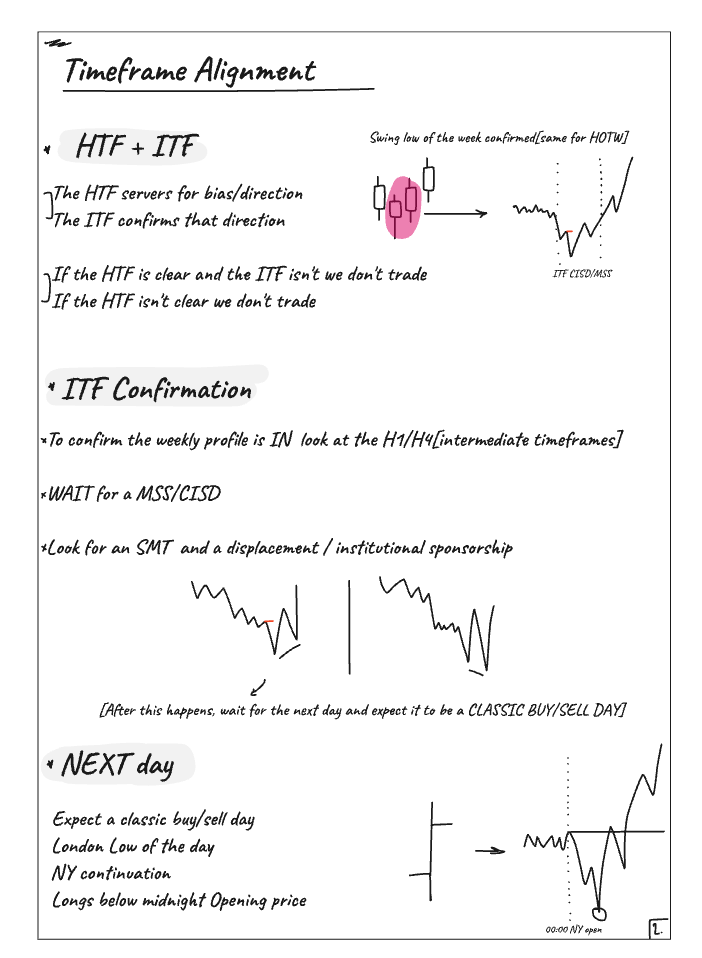

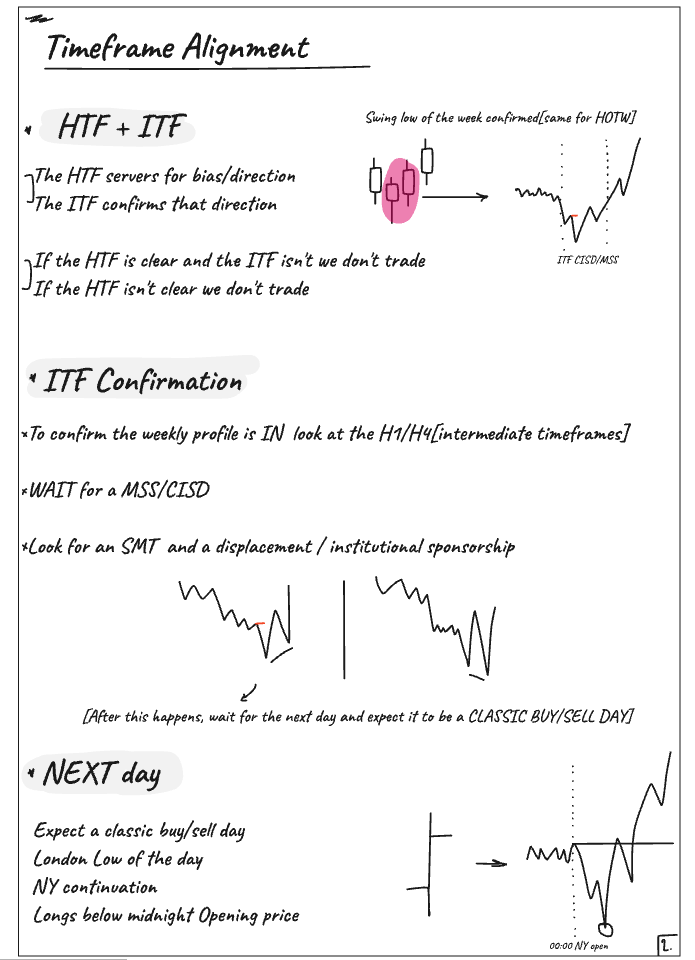

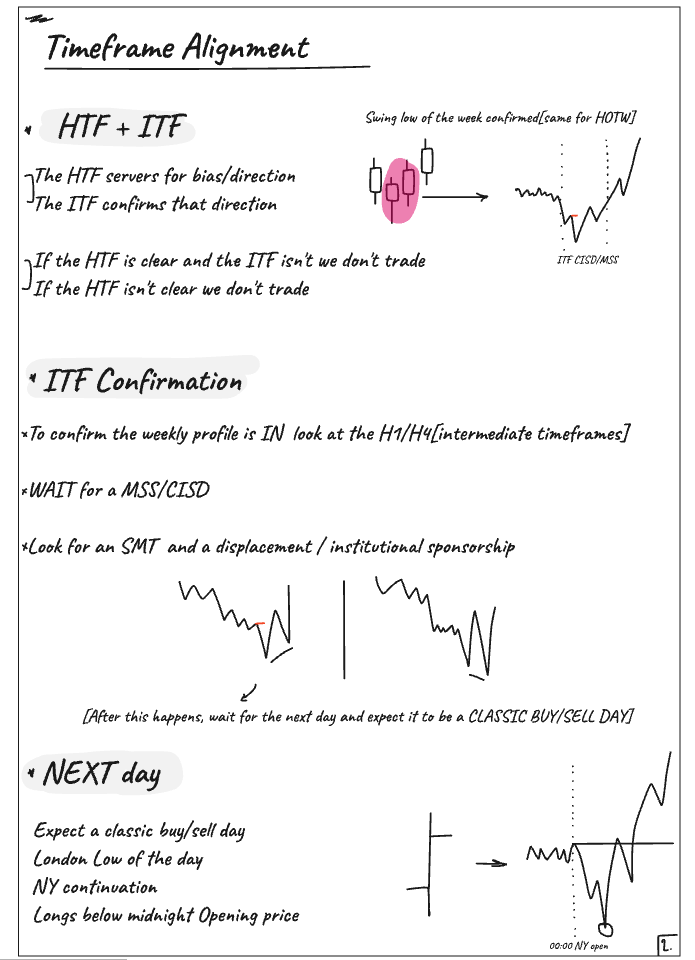

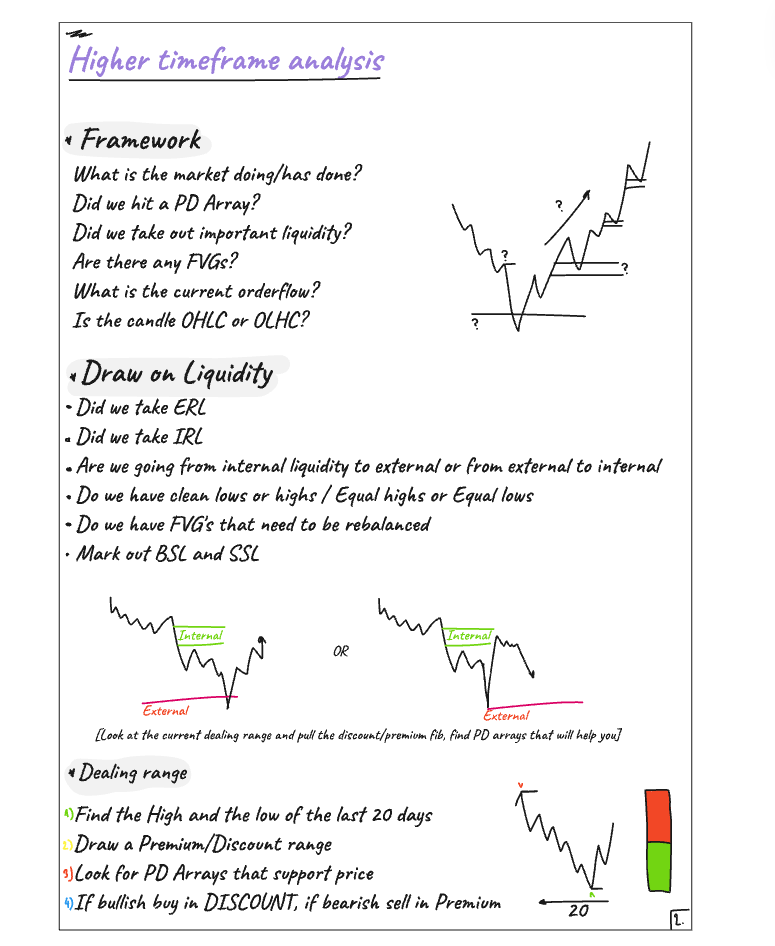

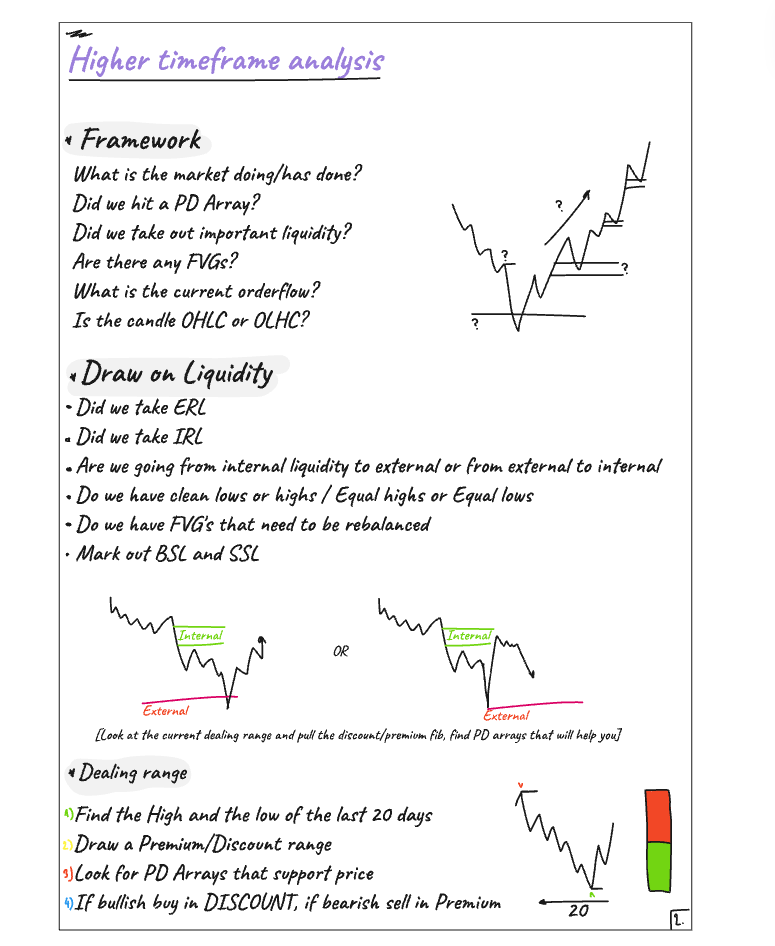

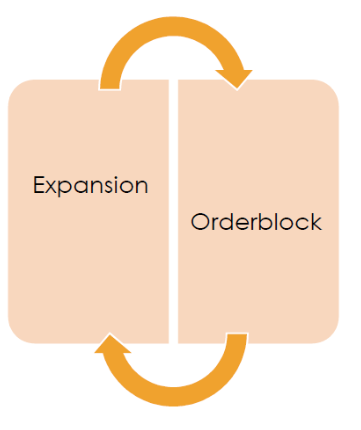

HTF

HTF

HTF

HTF

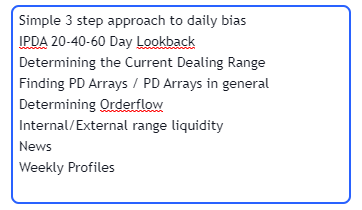

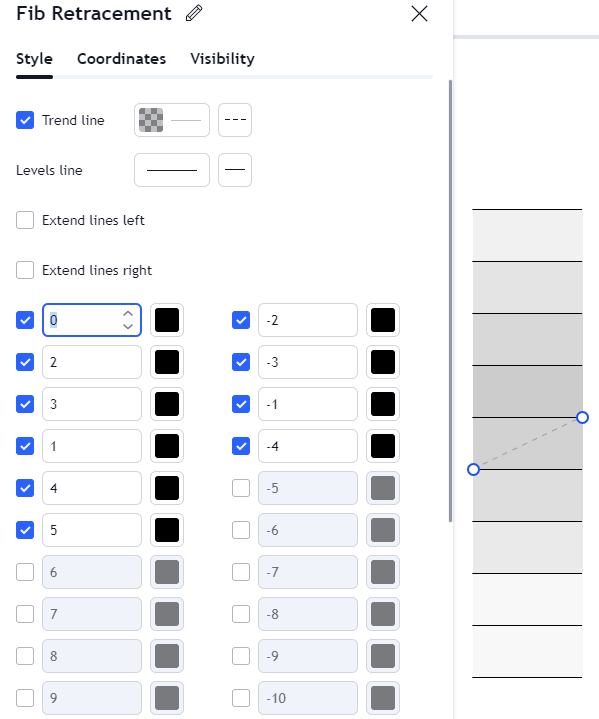

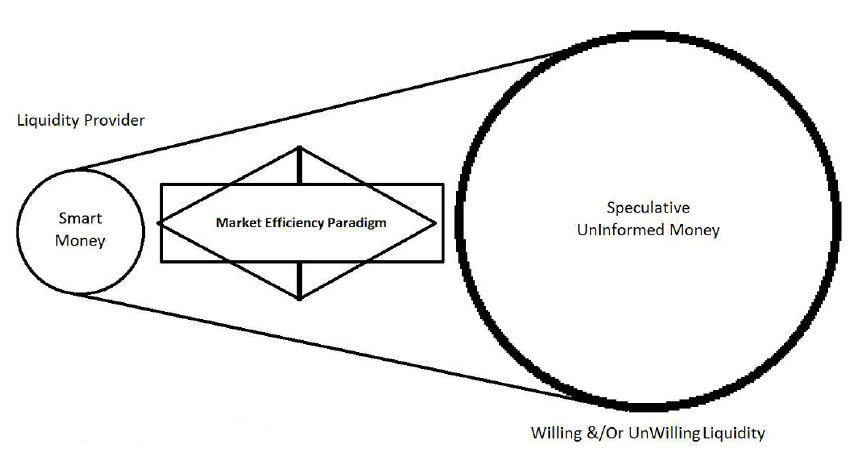

1) Figure out the framework

1) Figure out the framework

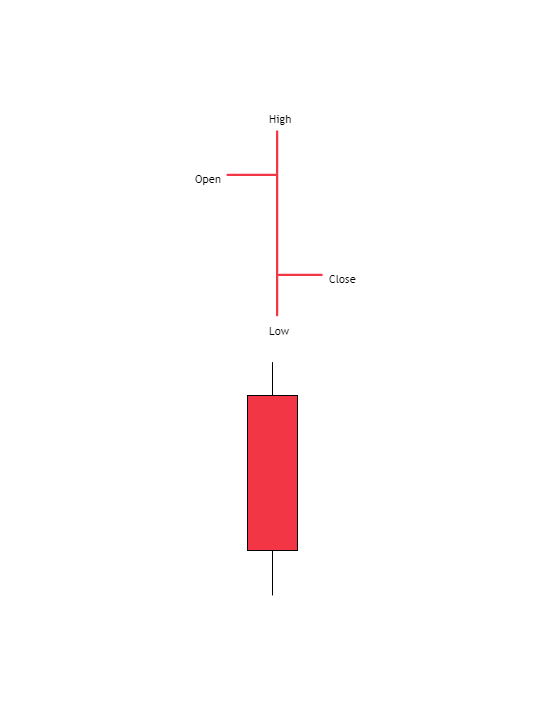

Entry:

Entry:

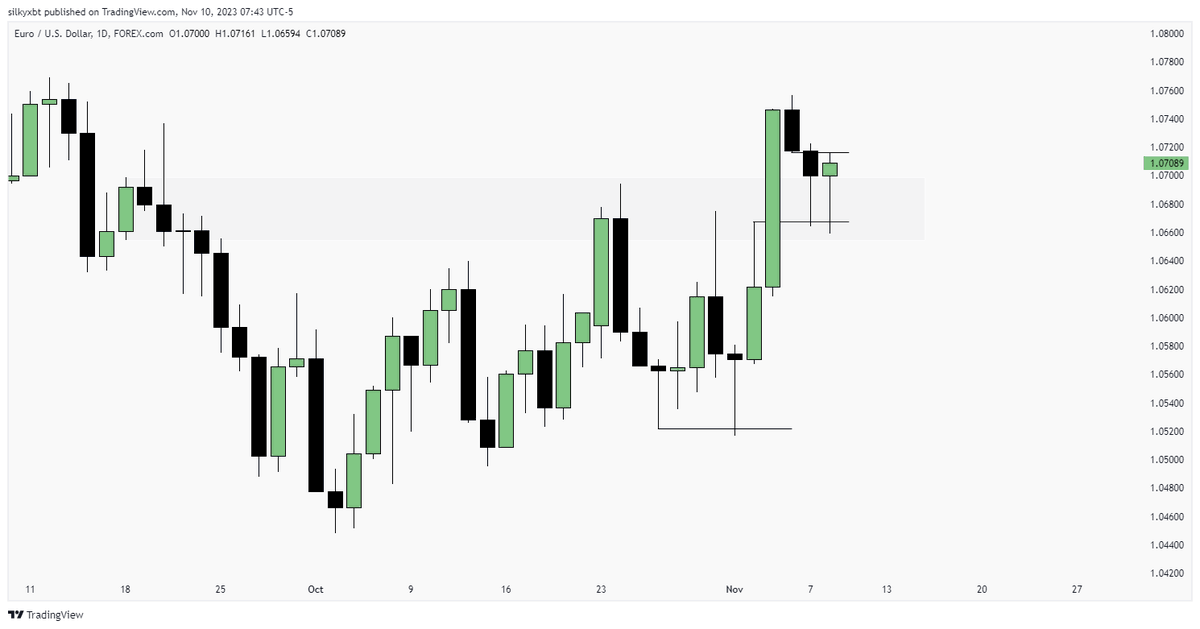

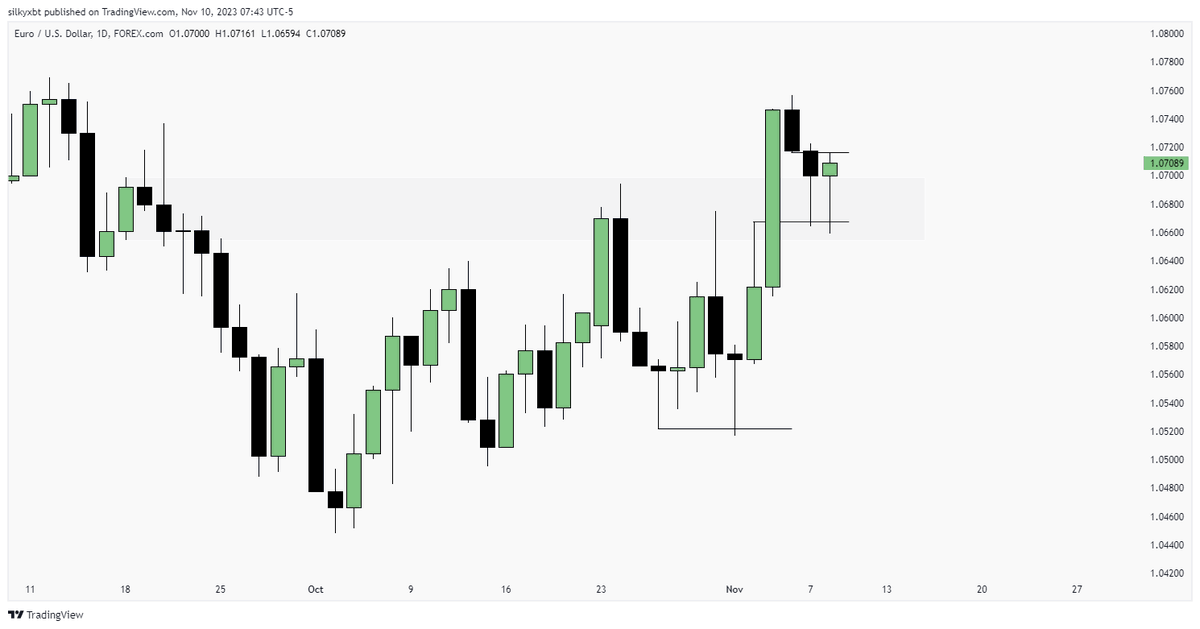

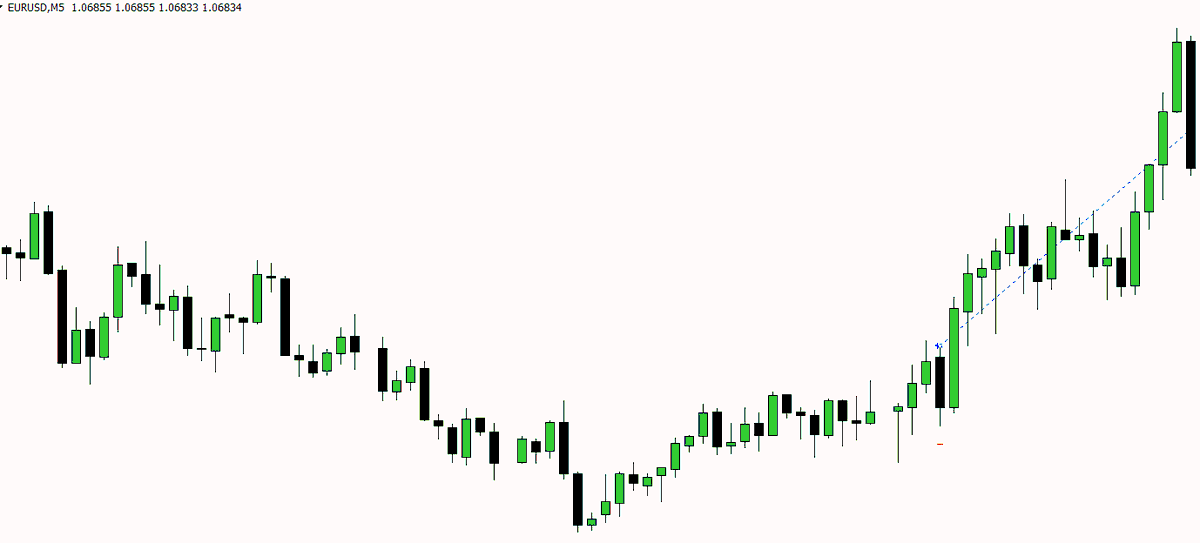

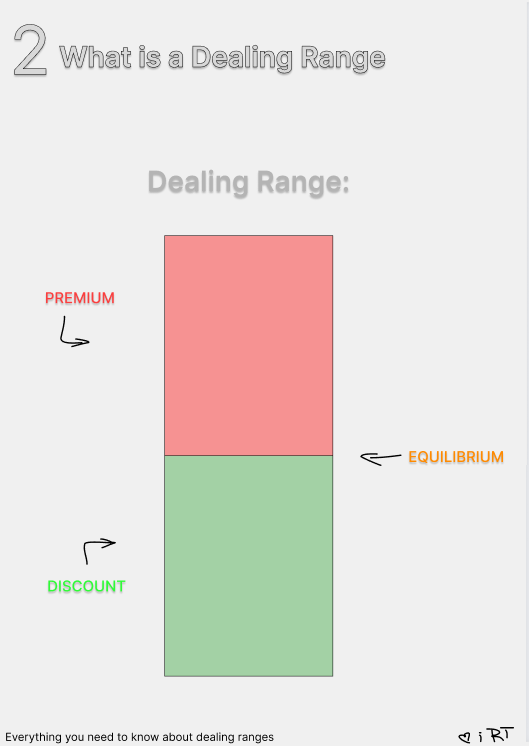

This thread is part 2 of series of threads I am doing on Dealing Ranges. I took a few weeks of for people to catch up we're back now.

This thread is part 2 of series of threads I am doing on Dealing Ranges. I took a few weeks of for people to catch up we're back now. https://twitter.com/silkyfx/status/1683205142076612609?s=20

https://twitter.com/silkyfx/status/1671594850641145857?s=20

https://twitter.com/silkyfx/status/1670134283569176578?s=20

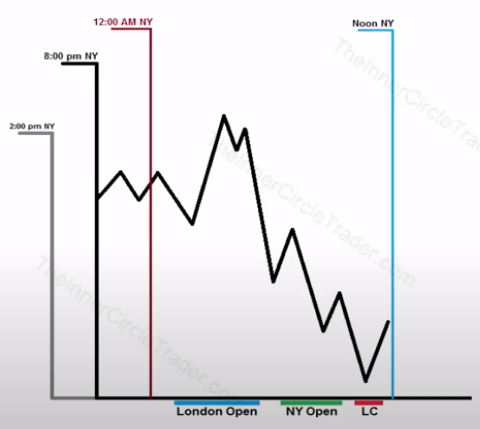

You Ideally always want to buy below New York Midnight(True Day Open)

You Ideally always want to buy below New York Midnight(True Day Open)