🏰 Quality Stocks 🧑💼 Former Professional Investor ➡️ Teaching people about investing on our website.

134 subscribers

How to get URL link on X (Twitter) App

1. Stocks aren’t lottery tickets

1. Stocks aren’t lottery tickets

10. Domino's Pizza ($DPZ)

10. Domino's Pizza ($DPZ)

1. Net Debt/EBITDA

1. Net Debt/EBITDA

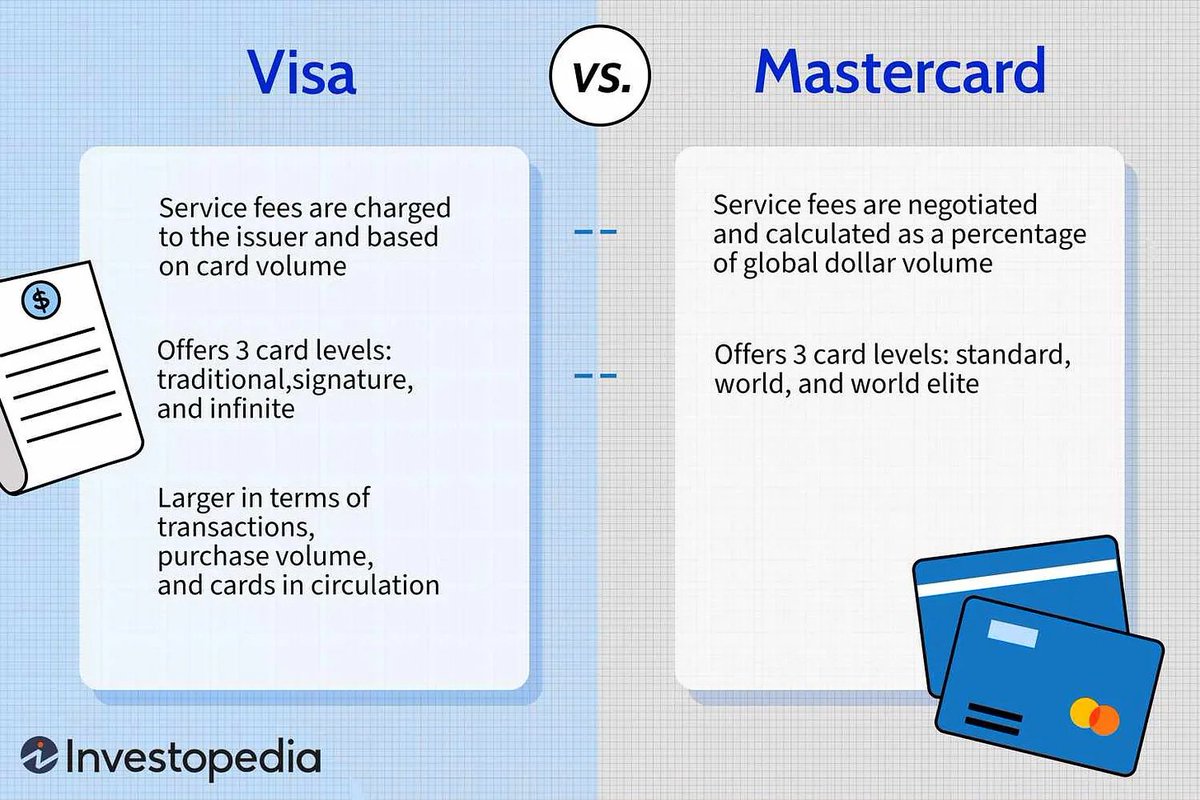

10. Mastercard & Visa

10. Mastercard & Visa

1. Keep It Simple

1. Keep It Simple

Lesson 2: On average, you double your money in the stock market every 10 years.

Lesson 2: On average, you double your money in the stock market every 10 years.

1. Price ≠ Value

1. Price ≠ Value

1. Arista Networks (ANET): -26%

1. Arista Networks (ANET): -26%

1. Buy-and-build

1. Buy-and-build